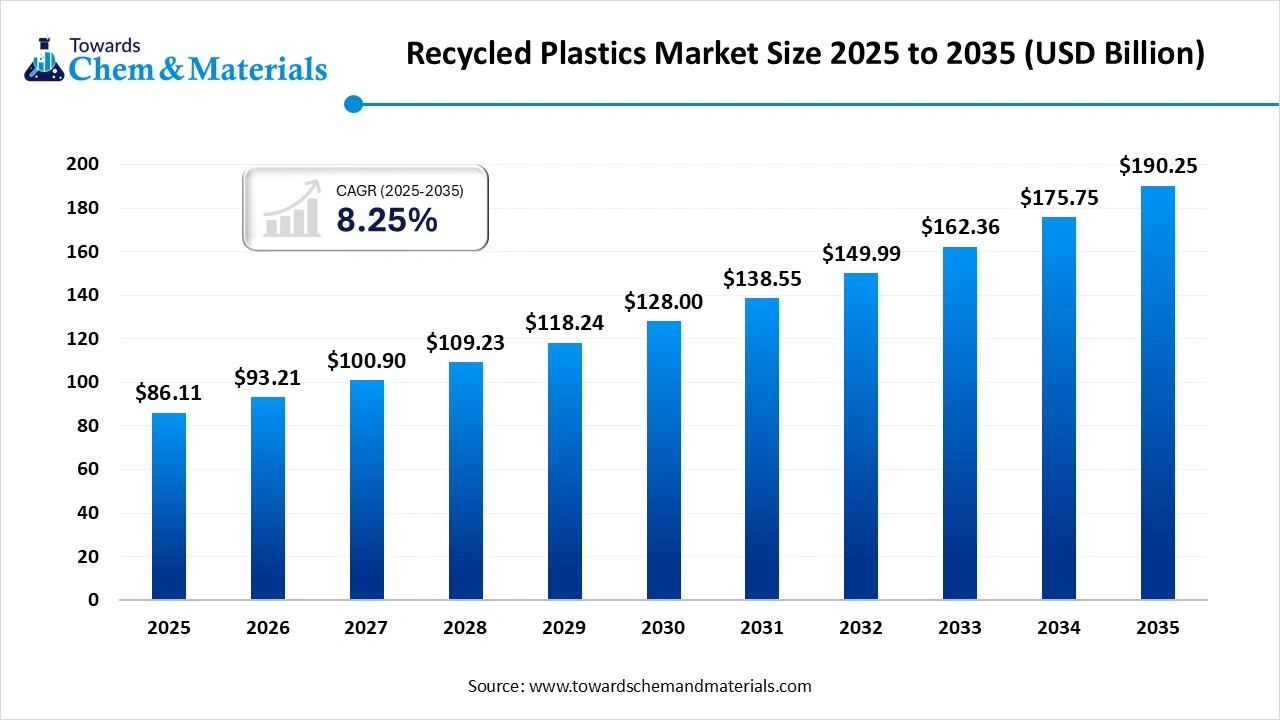

Recycled Plastics Market Size to Worth USD 190.25 Bn by 2035

According to Towards Chemical and Materials Consulting, the global recycled plastics market is projected to grow from USD 86.11 billion in 2025 to USD 190.25 billion by 2035 growing at a CAGR of 8.25% from 2026 to 2035.

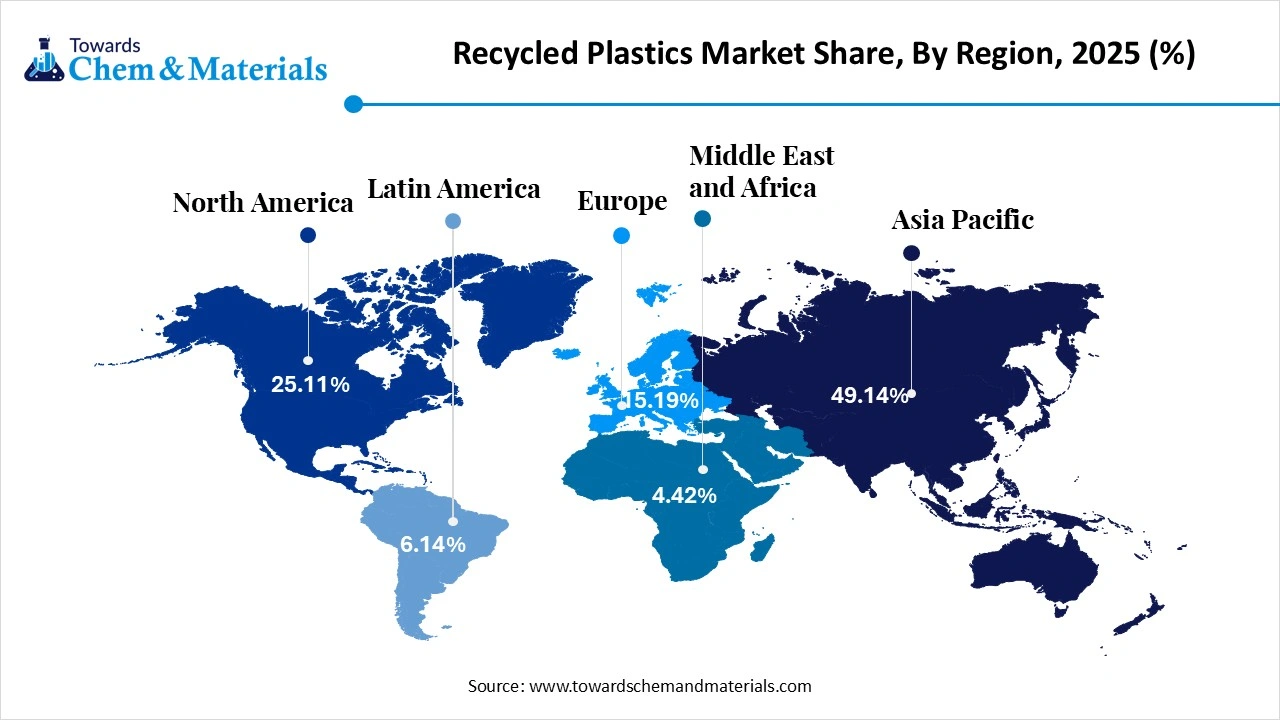

Ottawa, Nov. 25, 2025 (GLOBE NEWSWIRE) -- The global recycled plastics market size was valued at USD 86.11 billion in 2025, the market is projected to grow from USD 93.21 billion in 2026 to USD 190.25 billion by 2035 at a CAGR of 8.25% during the forecast period. Asia Pacific dominated the recycled plastics market with a market share of 49.14% in 2025. Rising demand for sustainable materials, stricter regulations on plastic waste, and increasing corporate commitments to circular economy practices are driving growth in the recycled plastics market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5793

What are Recycled Plastics?

The recycled plastics market is expanding steadily as global efforts intensify to reduce plastic waste and transition toward circular material systems. Growing adoption across packaging, automotive, construction, and consumer goods industries is boosting demand for high-quality recycled resins. Technological advancements in mechanical and chemical recycling are improving output purity and widening application possibilities. Governments worldwide are enforcing stricter sustainability regulations, further accelerating market growth. Overall, the market is shifting from a waste-management model to a value-driven, resource-efficient industry.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Recycled Plastics Market Report Highlights

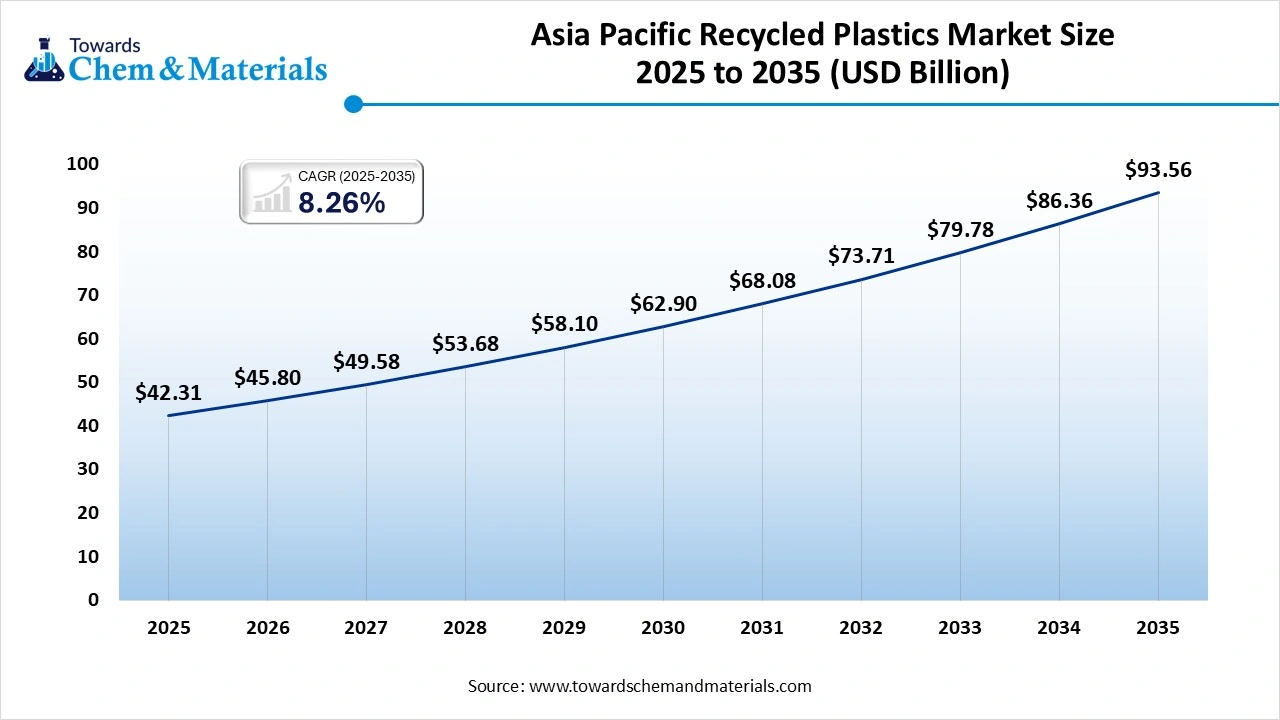

- Asia Pacific dominated the global recycled plastics market with the largest revenue share of 49.14% in 2025.

- The China recycled plastics market is projected to grow during the forecast period.

- By source, the bottles segment accounted for the largest revenue share of 75.16% in 2025.

- By polymer type, the PET segment dominated with the largest revenue share of 38.47% in 2025.

- By process, the mechanical recycling segment dominated with the largest revenue share of 70.74% in 2025.

- By product form, the flakes segment led the market and accounted for 75.34% of the global revenue share in 2025.

- By application, the packaging segment accounted for the largest revenue share of 39.35% in 2025.

The Different Types of Recycled Plastics

There are different types of plastics that can be easily recycled. Understanding the various types of recyclable plastics is essential in identifying unique applications and its benefits for ecologically-friendly manufacturing. Each group of recycled plastic possesses specific properties and is identified according to the resin codes, making it applicable for specific use. Let’s take a closer look at the most common ones:

Polyethylene Terephthalate (PET):

- This plastic is one of the most recycled kinds of plastics for the reasons of its high clarity and strength. PES can be further processed into fibers for clothing, carpets, insulation, and other new containers of food and beverage. This makes it suitable as well as recyclable to look attractive for sustainable manufacture in the textile as well as the packaging industry.

High-Density Polyethylene (HDPE):

- HDPE is tough and resistant to chemicals. Such household items containing this plastic are milk jugs, shampoo bottles, and detergent containers. This plastic is most commonly recycled in piping, plastic lumber, and some playground equipment as well as back into new bottles. HDPE is dense and heavy, making the application of products qualify for structural integrity, thereby being a reliable material source for recycled products.

Polyvinyl Chloride (PVC):

- PVC is a tough, strong plastic often used in piping and medical supplies or occasionally building products. Although not as common due to its complex chemical makeup, PVC recycling can be applied in durable applications like flooring and window frames. The recycling of PVC is gaining momentum since improved methods are being developed. Therefore, it’s a feasible, even if limited, source for certain sectors of industry.

Low-Density Polyethylene (LDPE):

- LDPE is flexible and has been widely used for plastic bags, films, and many containers, although its recycling is a bit more difficult and requires being recycled to be reused again for purposes like making trash can liners, floor tiles, furniture, or shipping envelopes. LDPE’s recyclability is now becoming greater than before, hence it now allows manufacturing of stronger and more functional products.

Polypropylene (PP):

- This versatile plastic is used for everything from food containers to automobile parts. Polypropylene can be recycled to produce cases for batteries, signal lights, storage bins, and even furniture designed for outdoor use. Because of its strength and resistance to heat, PP proves to be a highly valuable material for use in recycled manufacturing, especially for products that are expected to last under stress.

Each type brings distinct attributes to eco-friendly production processes and, therefore, increases the sustainability and efficiency of the production process. By knowing the benefit and limitation associated with each one, a manufacturer will thus make better decisions regarding incorporation in products and reduce waste while promoting sustainability.

Why is Recycling Plastic Important?

Plastic waste accumulation is a serious issue in contemporary times. Plastics are made with the intent to last longer and hence it is not biodegradable. Unfortunately, these wind up as waste in our oceans or in landfills, affecting the ecosystem and wildlife. The chemical composition that makes it non-biodegradable is harmful when buried in soil, contaminating the groundwater. Moreover, dumping plastic waste into the water bodies is also a serious issue, marine creatures tend to swallow and choke on them. This results in a steady decline in their population. Recycling plastic waste aids in reducing these problems. This results in less need to build new landfills by recycling plastic waste rather than disposing of it in the ocean or landfills.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5793

Recycled Plastics Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 93.21 Billion |

| Revenue forecast in 2035 | USD 190.25 Billion |

| Growth rate | CAGR of 8.25% from 2026 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2018 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative Units | Volume in kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2035 |

| Report coverage | Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Source, By Polymer Type, By Recycling Process, By Product Form, By End-Use Industry / Application, By Region |

| Regional scope | North America; Europe; Asia Pacific; Southeast Asia; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Malaysia; Indonesia; Thailand; Brazil; Saudi Arabia |

| Key companies profiled | REMONDIS SE & Co. KG; Biffa; Stericycle; Republic Services, Inc.; WM Intellectual Property Holdings; L.L.C.; Veolia; Shell International B.V.; Waste Connections; CLEAN HARBORS, INC.; Covestro AG |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

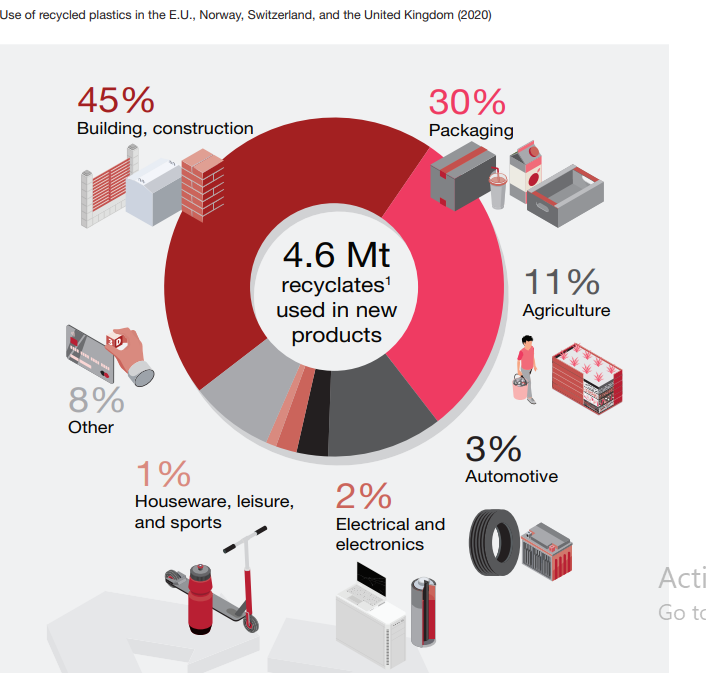

Europe uses just under half of all post-consumer recycled plastics in building materials

Benefits of Using Recycled Plastics Market

Recycling plastics in production is a smart move for the planet and the pocket. It swaps out new plastics for recycled ones, saving natural stuff like oil and cutting down on fossil fuels. This fits nicely with our goals for a greener planet. Plus, it takes less energy to make something from recycled plastics than from new ones. This is more energy-saving, and it also makes our carbon footprint smaller. That’s a big thumbs-up in the fight against climate change and for tidier production habits. By recycling, we’re also tackling the huge problem of plastic waste. We’re keeping plastic out of dumps, seas, and the great outdoors. This helps us manage waste better and make our ecosystem healthier. On top of the green gains, using recycled plastics also chimes with the “circular economy.” This system is all about reusing things instead of throwing them away. With recycling, businesses can help feed this circular process. They can turn waste into something worthwhile and take some pressure off the planet.

The Future of Recycled Plastics in Eco-friendly Manufacturing

Recycled plastics hold a bright future in green production, encouraged by advancements in technology and supportive rules. New recycling methods, like chemical recycling, make recycled plastics almost as good as new ones. This opens up more ways they can be used – even in areas where the quality of material matters a lot. Also, these methods let us recycle plastics that were tough to recycle before, growing green manufacturing possibilities. At the same time, across the globe, policies and regulations are nudging businesses to go for recycled stuff. From governments to organizations, there are big goals set on plastic recycling and prizes for green habits, pushing industries to use recycled plastics. These plastics are now seen as a real and sustainable switch from new plastics. All these changes show a firm future for recycled plastics, hinting at a wide acceptance and a tie-in with care for the environment and sustainability.

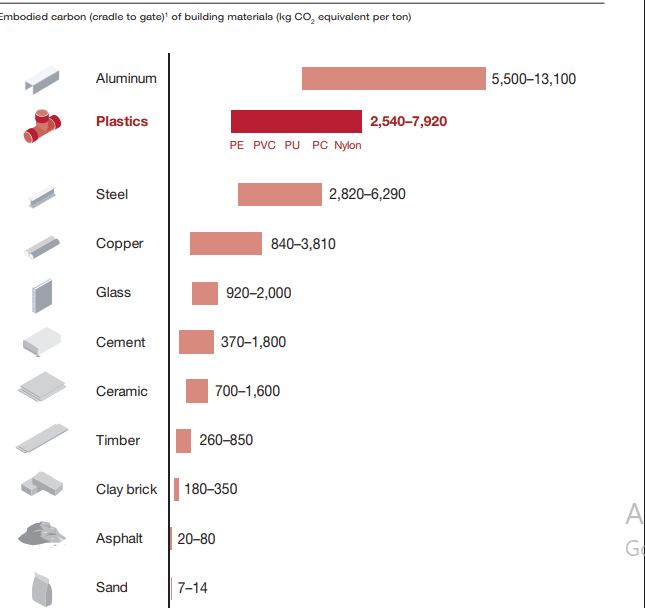

Some of the most important building materials contain considerable embodied carbon

AI Drives the Next Wave of Circular Plastics Innovation

AI is transforming the recycled plastics industry by optimizing sorting processes, enabling more accurate identification of polymers and contaminants. It enhances recycling plant efficiency through predictive maintenance, reducing downtime and operational costs. AI-driven quality control systems help produce more consistent, high-grade recycled resins that meet industrial standards. Additionally, AI-powered supply chain analytics improve material traceability and demand forecasting, strengthening the circular economy ecosystem.

Private Industry Investments in the Recycled Plastics Industry:

- Coca-Cola’s rPET Expansion Projects – The company is investing in large-scale rPET processing facilities to increase recycled content in its beverage packaging and meet global sustainability targets.

- Unilever’s Plastic Waste Reduction Programs – Unilever is funding advanced recycling partnerships to secure high-quality recycled plastics for its home and personal care product lines.

- Berry Global’s Recycling Infrastructure Investments – Berry Global is expanding mechanical recycling capacity to supply more post-consumer recycled materials for packaging solutions.

- BASF’s Chemical Recycling Initiatives – BASF is investing in chemical recycling technologies to convert hard-to-recycle plastics into high-quality feedstock for industrial applications.

-

Dow’s Circular Plastics Collaborations – Dow is partnering with recycler networks and funding new processing plants to increase access to recycled polymers for flexible packaging and industrial uses.

What are the Key Trends of the Recycled Plastics Market?

- Expansion of Advanced Recycling Technologies: The industry is scaling up advanced solutions like chemical recycling and AI-powered sorting to handle difficult plastics. These innovations improve efficiency and produce high-quality materials competitive with virgin plastic.

- Stringent Regulations and Corporate Commitments: Governments are implementing mandates for minimum recycled content and plastic bans, while major corporations are making public sustainability pledges. These actions create a strong, compliance-driven market push for recycled materials.

-

Increasing Demand for High-Quality Recycled Content: Brands across various sectors require high-quality recycled resins (like rPET and rHDPE) to meet sustainability goals and consumer preferences. This growing demand moves recycled plastic from a niche alternative to a mainstream resource.

Market Opportunity

The Surge of Food-Grade rPET: The Next Big Breakthrough in Recycled Plastics

A major opportunity in the recycled plastics market lies in the rapid expansion of food-grade rPET production, driven by global demand for sustainable packaging. Advances in purification and decontamination technologies are enabling recyclers to produce high-quality rPET that meets strict safety standards. This shift opens doors for beverage, dairy, and ready-to-eat food brands seeking to boost recycled content in their packaging. As regulations tighten and consumer preference for eco-friendly packaging grows, food-grade rPET is becoming a high-value segment with strong long-term growth potential.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5793

Recycled Plastics Market Segmentation Insights

Source Insights

In 2024, the bottles segment dominated the market, due to strong demand from beverage and personal care brands seeking higher recycled content in their packaging. Regulatory pressures, including mandates for minimum rPET usage, further accelerated bottle-to-bottle recycling initiatives. Technological improvements in PET collection, sorting, and decontamination made it easier to produce high-quality, food-grade recycled resin.

The films & sheets segment is projected to grow fastest over the forecast period, due to strong demand from packaging industries seeking cost-effective and sustainable alternatives to virgin plastics. Recycled polyethylene and polypropylene became widely used for flexible packaging, agricultural films, and industrial liners as quality and consistency improved. Advances in mechanical recycling technology allowed processors to produce higher-strength recycled materials suitable for more demanding applications.

Polymer Type Insights

The polyethylene terephthalate (PET) segment led the market in 2024, because it has the highest recyclability rate and strong demand from the beverage and food packaging industries. PET’s ability to be efficiently converted into high-quality, food-grade rPET made it the preferred material for bottle-to-bottle recycling programs. Expanding regulatory mandates for minimum recycled content in packaging further boosted PET recycling volumes.

The high-density polyethylene (HDPE) segment is growing fastest in the market, due to its versatile use in packaging, containers, and industrial products, driving strong demand for recycled HDPE. Its durability and ability to maintain performance even after multiple recycling cycles made it a preferred material for closed-loop applications. Growing adoption of recycled HDPE in personal care bottles, household products, and industrial drums further boosted its market share.

Recycling Process Insights

The mechanical recycling segment dominated the market in 2024 because it remains the most cost-effective and widely adopted method for processing common plastics like PET, HDPE, and PP. Its ability to produce high-quality recycled resins with relatively low energy consumption made it attractive for large-scale commercial use. Continuous improvements in sorting, washing, and extrusion technologies enhanced output purity, widening its application across packaging, automotive, and consumer goods.

The chemical recycling segment is the second-largest segment, leading the market, because it can break down hard-to-recycle plastics that mechanical systems cannot process, expanding the range of recoverable materials. Its ability to produce virgin-grade feedstock made it highly attractive for industries requiring high-purity resins, especially food and pharmaceutical packaging. Significant private and government investments accelerated the commercialization of pyrolysis, depolymerization, and solvent-based technologies.

Product Form Insights

The flakes segment dominated the market in 2024 because flakes are the most widely used intermediate form for producing rPET, rHDPE, and rPP across multiple industries. Their cost-effectiveness and ease of processing made them the preferred choice for manufacturers in packaging, textiles, and consumer goods. Improved collection and sorting technologies boosted the supply of high-quality flakes, supporting consistent large-scale production.

The pellets/granules segment is growing fastest in the market, because it offers a standardized, easy-to-process form that fits seamlessly into existing manufacturing systems. Their consistent quality and uniform size made them ideal for high-performance applications in packaging, automotive parts, and household products. Advances in extrusion and pelletizing technologies enabled the production of premium recycled pellets with improved strength and purity.

End-user Industry/Application Insights

The packaging segment led the market in 2024 because consumer goods, food, and beverage companies significantly increased their use of recycled content to meet sustainability goals. Strict regulations on plastic waste and mandatory recycled-content requirements drove higher adoption of rPET, rHDPE, and rPP in bottles, films, and containers. Advances in recycling technologies improved the quality of recycled resins, making them suitable for more demanding packaging applications.

The automotive & transportation segment is expected to lead the market over the forecast period, due to increasing adoption of lightweight and sustainable materials to improve fuel efficiency and reduce vehicle emissions. Manufacturers incorporated recycled plastics in interior components, bumpers, and under-the-hood applications, driving strong demand for high-quality rPP, rHDPE, and rPET. Advancements in material processing and quality control enabled recycled plastics to meet stringent automotive performance and safety standards.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Asia Pacific Takes the Lead in the Global Recycled Plastics Boom

The Asia Pacific recycled plastics market size was valued at USD 42.31 billion in 2025 and is expected to reach USD 93.56 billion by 2035, growing at a CAGR of 8.26% from 2025 to 2035. Asia Pacific dominated the recycled plastics market share of 49.14% in 2025.

Asia Pacific dominates the market due to its massive manufacturing base and high plastic consumption across the packaging, automotive, and consumer goods industries. Rapid industrialization and strong government policies in countries like China, India, and Japan are accelerating investments in large-scale recycling infrastructure. The region also benefits from the abundant availability of post-consumer plastic waste, supporting a continuous supply for recyclers. Additionally, growing sustainability commitments from regional brands and global companies operating in the Asia Pacific further strengthen its leadership in the market.

China Recycled Plastics Market Trends

China is a major contributor to the recycled plastics market. The presence of a large manufacturing base in sectors like electronics & packaging increases demand for recycled plastics. The growing utilization of food delivery services and the expansion of the e-commerce sector increase demand for recycled plastics. The government has a strong focus on sustainability, and low labor costs increase production of recycled plastics, supporting the overall growth of the market.

Japan Recycled Plastics Market Trends

In Japan, the recycled plastics industry is gaining traction thanks to stricter government policies and a growing emphasis on circular economy goals, including a target to boost domestic use of recycled content. Recycling volumes are increasing through a mix of material, chemical, and thermal recycling, although much of the plastic waste still undergoes thermal recycling rather than being converted back into high-quality resin. There is a rising push toward high-purity recycling streams, especially for food-grade PET, with recent investments in a Veolia circular PET plant aimed at producing food-safe rPET locally.

The recycled plastics market in North America is expected to grow at a significant CAGR over the forecast period. The North America market accounted with a revenue share of 25.11% in 2025. The market is driven by the growth of the major end-use industries such as electrical & electronics, construction, and packaging. Rising demand for packed & processed food and rising construction industry in the U.S., Mexico and Canada are anticipated to augment market growth over the forecast period.

U.S. Recycled Plastics Market Trends

The recycled plastics market in U.S. is expected to grow at the fastest CAGR over the forecast period. Polyethylene terephthalate, low-density polyethylene, high-density polyethylene, polypropylene, polyvinyl chloride, and polystyrene are the most common types of plastic waste in the country. These plastics are used to produce food & beverage bottles, films & wraps, bottles caps, containers, and blister packs among other products.

Europe Races Ahead as the Fastest-Growing Force in Recycled Plastics

Europe is the fastest-growing region in the recycled plastics market thanks to its stringent environmental regulations and ambitious circular economy policies. The European Union’s mandates on recycled content in packaging are pushing industries to accelerate the adoption of high-quality recycled polymers. Strong investments in advanced mechanical and chemical recycling technologies are boosting production capacity across the region. Additionally, rising consumer awareness and brand commitments to sustainability are fueling rapid market expansion in Europe.

The UK Recycled Plastics Market Trends

In the UK, recycled plastics are under pressure as domestic recycling rates slipped in 2024 despite strong circular-economy ambitions. Closures of several recycling sites and delays in critical policy reforms have squeezed the industry’s capacity. Meanwhile, the Plastic Packaging Tax is pushing companies to use more recycled content, but soft legislation and export of waste remain concerns.

The Germany recycled plastics market held a significant share in Europe. The market is anticipated to register at the fastest CAGR of 10.11% over the forecast period. The advanced recycling technologies of Germany significantly influences the demand for recycled plastics in the country. According to the report of Federal Ministry for Environment, Nature Conservation, Nuclear Safety and Consumer Protection, in 2023, Germany generated 340 million tons of plastic waste per year and had a recycling of wastes is approximately 50 million tons.

The recycled plastics market in Italy is expected to grow at a significant CAGR over the forecast period. The Italy market is quite active and involves more than 355 companies. These companies include waste collectors, sorters, and industrial waste handlers. The cultural emphasis of Italy towards sustainable products is expected to boost the demand for recycled plastics in several industries including automotive and textiles.

Central & South America Recycled Plastics Market Trends

The recycled plastics market in Central & South America is expected to witness at the significant CAGR over the forecast period. The rise of e-commerce and changing consumer preferences towards sustainability including plastic recycling in Central & South America are contributing to the demand for recycled plastics in packaging.

The Brazil recycled plastics market held the significant share in Central & South America. The market is anticipated to register at the fastest CAGR of 8.25% over the forecast period. The country has huge potential for recycled plastics as these would solve both the plastic waste problem as well as floods occurring due to plastic waste in water bodies.

Middle East & Africa Recycled Plastics Market Trends

The recycled plastics market in Middle East & Africa is expected to witness at a significant CAGR over the forecast period. The region was dependent on exporting its plastic waste to other countries for recycling, but as the Asia Pacific and Southeast Asia countries are banning the plastic waste imports, the region is developing recycling facilities.

The Saudi Arabia recycled plastics market held a significant share in Middle East & Africa. The market is anticipated to register at the fastest CAGR of 7.45% over the forecast period. The flourishing building & construction industry in the country is expected to drive the demand for recycled plastics in the country.

Top Companies in the Recycled Plastics Market & Their Offerings:

- SABIC: Offers certified circular polymers via advanced (chemical) and mechanical recycling processes.

- Dow Chemical: Provides REVOLOOP™ post-consumer recycled (PCR) and advanced recycled resins with near-virgin performance.

- Veolia: Produces high-quality, ready-to-use circular polymers through its network of mechanical and chemical recycling plants.

- BASF: Utilizes the ChemCycling® process to produce certified circular products with virgin properties from non-mechanically recyclable plastic waste.

- Indorama Ventures: Focuses on an integrated approach to process various plastic waste types into recycled PET and polyolefins products.

- LyondellBasell: Provides Circulen resins via mechanical and advanced recycling technologies to offer sustainable material solutions.

- Mitsui Chemicals: Is developing chemical recycling and biomass use to create a circular economy for plastics.

- TotalEnergies: Is involved in advanced recycling via pyrolysis to transform mixed plastic waste into virgin-quality polymer feedstock.

- Envision Plastics: Specializes in producing high-quality, post-consumer resin (PCR) from HDPE plastic bottles.

- Green Dot Bioplastics: Offers sustainable biocomposites and biodegradable polymers made from sustainable and recycled content.

More Insights in Towards Chemical and Materials:

Polymers Market Size to Reach USD 1,351.59 Billion by 2034

Liquid Crystal Polymers Market Size to Hit USD 6.73 Billion by 2034

Bio-Based Polymers Market Size to Hit USD 58.36 Billion by 2034

Medical Fluoropolymers Market Volume to Reach 13.87 Kilo Tons by 2034

Bioresorbable Polymers Market Volume Reach 3,839.1 kilotons by 2034

Recycled Engineering Plastics Market Size to Hit USD 7.89 Billion by 2034

Recycled Plastic Pipes Market Size to Hit USD 20.08 Billion by 2034

Recycled PET Flakes Market Size to Surge USD 36.06 Billion by 2034

Recycled PET (rPET) Market Size to Surge USD 29.19 Billion by 2034

Recycled Polystyrene Market Size to Hit USD 7.49 Bn by 2034

Recycled Plastics In Green Building Materials Market Size and Share 2034

Recycled thermoplastics Market Size to Exceed USD 145.34 Bn by 2034

Biodegradable Plastics Market Size to Reach USD 91.26 Billion by 2034

Plastics Market Size to Worth USD 984.11 Billion by 2034

Sustainable Plastics Market Size to Hit USD 1,448.23 Bn by 2034

Circular Plastics Market Size to Hit USD 182.21 Billion by 2034

U.S. Transparent Plastics Market Size to Reach USD 35.15 billion by 2034

Transparent Plastics Market Size to Hit USD 245.19 Bn by 2034

Europe Bioplastics Market Volume to Reach 40.16 Million Tons by 2034

Plastics Extruded Market Size to Surge USD 259.21 Billion by 2034

Asia Pacific Bioplastics Market Volume to Reach 11.13 Million Tons by 2034

Bioplastics Market Volume to Reach 73,21,706.6 Tons by 2034

Europe Plastics Market Size | Companies Analysis 2025- 2035

Recycled Polyester Market Size to Hit USD 38.53 Bn by 2034

Recycled Polyolefin Market Size to Reach USD 144.2 Billion by 2034

Mechanical Recycling of Plastics Market Size to Surge USD 92.86 Bn by 2034

Commodity Plastics Market Size to Hit USD 666.76 Billion by 2034

U.S. Biodegradable Plastics Market Size to Hit USD 5.27 Billion by 2034

U.S. Recycled Plastics Market Size to Reach USD 131.33 Bn by 2034

Europe Recycled Plastics Market Size to Surpass USD 33.84 Bn by 2035

U.S. Recycled Polyester Market Size to Surpass USD 7.16 Bn by 2034

Asia Pacific Recycled Plastics Market Size to Surpass USD 72.11 Bn by 2034

U.S. Recycled Polyethylene Terephthalate Market Size and Share 2034

U.S. Recycled Plastics in Green Building Materials Market Size and Share 2034

U.S. Plastics Market Size to Surge USD 131.34 Billion by 2034

Recycled Plastics Market Top Key Companies:

- REMONDIS SE & Co. KG

- Biffa

- Stericycle

- Republic Services, Inc.

- WM Intellectual Property Holdings, L.L.C.

- Veolia

- Shell International B.V.

- Waste Connections

- CLEAN HARBORS, INC.

- Covestro AG

Recent Developments

- In November 2025, Commission Regulation (EU) 2025/2269 was issued by the EU to correct the regulation regarding the labeling of recycled plastic. This regulation includes the development of recycling technologies and the transfer of authorizations.

- In April 2025, the Indian government mandated to use of a defined percentage of recycled plastic content in packaging materials. This enforcement has been mandated across various industries, including FMCG, retail, pharmaceuticals, and e-commerce.

- In January 2024, Republic Services, Inc. announced the opening of a new Salt River recycling center. The new facility will play a vital role in improving recycling rates in the Valley as it has more modern technology and higher capacity than its predecessor. It is a 51,000-square-foot recycling center in the Salt River Pima-Maricopa Indian Community, designed to manage recyclables from approximately 1.4 million residents and over 2,000 businesses. The facility can process up to 40 tons of recyclables or eight truckloads per hour. This includes cardboard, paper, jugs, plastic bottles, metal food and beverage cans, and glass bottles and jars

Recycled Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Recycled Plastics Market

By Source

- Bottles

- Films & sheets

- Foams

- Fibres

- Non-bottle rigid

- Others (e.g., multi-layer packaging scraps, etc.)

By Polymer Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Others (e.g., Polycarbonate, PU, mixed polymers)

By Recycling Process

- Mechanical Recycling

- Chemical Recycling

- Thermal Recycling

- Novel/Advanced

By Product Form

- Flakes

- Pellets/granules

- Films/sheets (re-extruded)

- Resin powders/paste

- Specialty additive products (e.g., waxes, compatibilizers)

By End-Use Industry / Application

- Packaging

- Building & Construction

- Automotive & Transportation

- Textiles & Fibres

- Electrical & Electronics

- Consumer Goods

- Healthcare & Pharmaceuticals

- Agriculture & Gardening

- Other (e.g., stationery, miscellaneous)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5793

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.